In the previous blogs, I pointed out that partner investment funds (i.e. MDF, BDF) are transforming in response to the evolution of the indirect channel, including the adoption of partner ecosystems, alignment with customer buying journey, focus on long-term partner success, and increased competition for partner mindshare.

To transform partner investment funds, companies must reevaluate and realign the strategy, structure, funding, segmentation, allocation, enablement, and measurement of these funds. In this blog, I will highlight best practices for aligning investment fund activities with the partner’s experience level within your partner program.

Providing guidance to partners on activities based on their maturity and capabilities can help ensure funds provide optimal ROI. This guidance can be informally accomplished through the development of the joint business plan, or it can be a policy within the program. Microsoft guides partners to utilize available MDF based on their sales. Companies with relatively low sales are usually a sign the partner is relatively new to the vendor and should focus on partner readiness. In contrast, partners with higher sales should focus on market development.

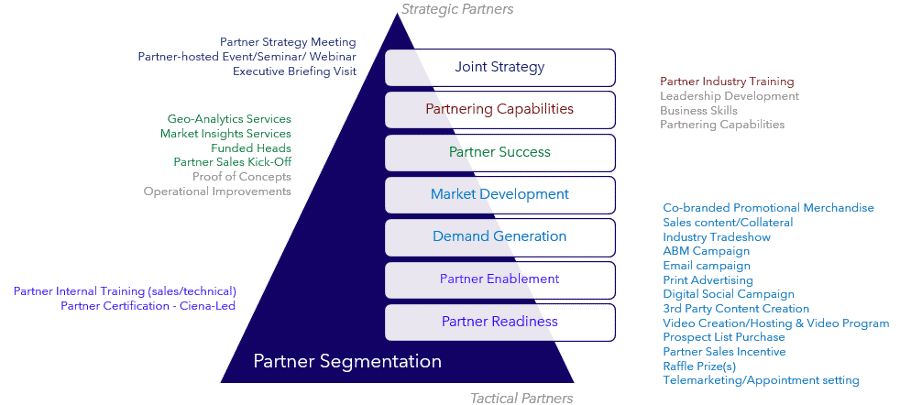

To add clarity to your activities, it is helpful to categorize them based on the relationship maturity. You can leverage a partner value proposition pyramid for this clarification, with tactical activities at the bottom and strategic alignment at the top. Partner investment fund activities can be aligned with the value proposition pyramid.

Some new partners are eager to engage in strategic alignment activities such as executive briefings and joint solution development, but it is more effective to start these partners off with tactical activities aligned with partner readiness and demand generation.

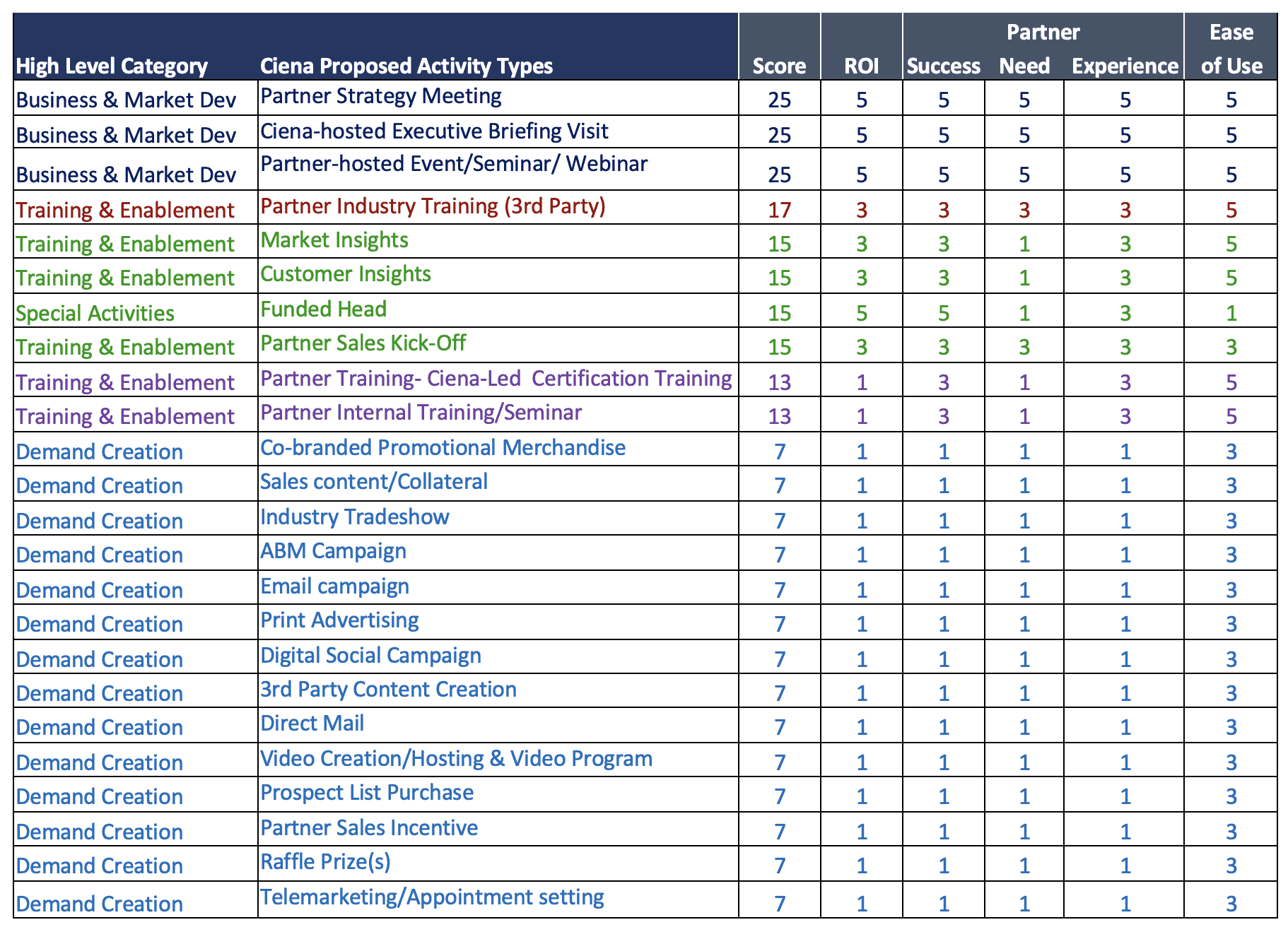

You can utilize a scoring system to help align your partner investment funds activities with partner maturity. Use a table like the one below to rank the attributes of the activities from two perspectives:

One perspective of mature strategically aligned partners and the other perspective of relatively new partners. Some of these new partners may evolve to be strategically aligned but they will get more value out of those activities after maturing from a partner readiness perspective. This provides a structure that helps steer partners away from requesting activities they are ready for. This allows you to create a partner growth path in terms of investment fund activities. A component of your joint planning could be an MDF roadmap that provides increasingly more strategic activities as the partner progresses on their partner journey through your program.

Not only will this approach optimize the value for the partners, but it will also allow you to allocate more strategic engagement resources to the partners at the top of your relationship hierarchy. These will result in a higher Return on Investment for your partners and your partner program.

Stay tuned for the last installment of this series, ‘Establishing and measuring investment funds success’. Did you miss Part 4 of the series? Click to read now.

Lead against your competitors with AchieveUnite Strategic Insights. Learn more today.